Are you ready for this year’s personal tax return? Here are our 2023 Tax Time Tips! Your Tax Time Tips for your 2023 Tax Return The low to medium income tax offsets (LMITO) of up to $1080.00 per tax payer introduced in 2019 has ended and the ATO wants you to know this may result […]

Start Of Business Year 2024 Requirements

Here’s a few important reminders about what business operators should put in place and be aware of for the start of this 2024 financial year: National minimum wage and award rate Businesses need to be aware that from the first full pay period on or after 1 July, the national minimum wage would increase to […]

IR Reforms: Annual Wage Review Decision See’s Min 5.75% Increase

- OnVenture Pty Ltd

- Hospitality, People, Productivity, Retail, Tax

On Friday, June 2nd, the Fair Work Commission released its annual wage review decision. The Commission has chosen to raise the minimum wages in all modern awards by 5.75%. These increases will go into effect from the first full pay period starting on or after July 1, 2023. Additionally, the National Minimum Wage has been […]

Federal Budget 2023-24 – Key Insights

Australia’s Treasurer, Mr Jim Chalmers handed down the 2023-24 Federal Budget on Tuesday, 9 May 2023. The Treasurer announced a package of cost-of-living measures, including up to $3bn in energy bill relief (expected to reduce power bills by up to $500 for 5 million households) and $1.3bn for home energy upgrades. These measures have been […]

Tax Time 2022

Its time again to get your tax return into the ATO and gain access to your tax refund! What you need to know for your 2022 tax return The low to medium income tax offsets of up to $1080.00 per tax payer introduced in 2019 has been extended for tax payers and will help secure […]

Federal Budget 2022-23 – Key Insights

Australia’s Treasurer, Mr Josh Frydenberg handed down the 2022-23 Federal Budget on Tuesday, 29 March 2022. The Treasurer said a strong economic recovery is well underway, notwithstanding the COVID-19 pandemic and new shocks, such as the recent floods and the Russian invasion of Ukraine. Mr Frydenberg said economic growth forecasts have been revised upwards, driven […]

Tax Time 2021

- OnVenture

- Tax

Its time again to get your 2021 tax return into the ATO and gain access to your tax refund! What you need to know for your 2021 tax return The low to medium income tax offsets of up to $1080.00 per tax payer introduced in 2019 have been extended for tax payers and will help […]

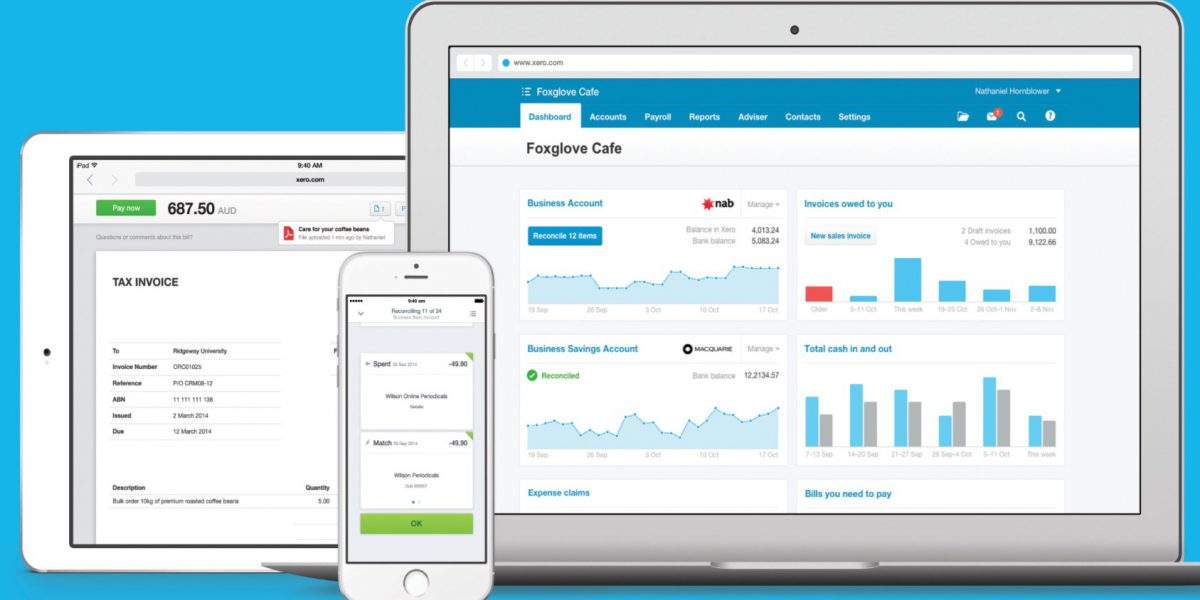

MYOB Essentials to Xero Conversions On The Rise!

We have been experiencing an unprecedented increase in MYOB Essentials to Xero Conversions over the last few months as many small businesses are loosing confidence in the MYOB cloud based product and looking to make the switch to Xero while retaining their transactional history. Key benefits in converting to Xero: Many conversion clients have complained […]

Federal Budget 2021 Accounting & Tax Insights

Australia’s Treasurer, Mr Josh Frydenberg, handed down the 2021–22 Federal Budget at 7:30 pm (AEST) on 11 May 2021. A stronger than expected economic recovery from the COVID-19 recession has resulted in a budget deficit of $161 billion, $52.7 billion lower than the government’s expected deficit. Given the virus continues to be a threat to […]

Tax Time 2020

- Onventure

- Tax

Its time again to get your 2020 tax return into the ATO and gain access to your tax refund! What you need to know for your 2020 tax return The low to medium income tax offsets of up to $1080.00 per tax payer introduced in 2019 continues to be available For those who use the […]